The economy has halted many of the Sri Lankan’s dreams and has cut down expenditures to enjoy life on a frequent basis. It can get very difficult to manage spending when inflation doesn’t stake at one rate.

Families are struggling to make ends meet with their earnings as little as the prices of goods available in the consumer market. Loans pile up due to the irregular monitoring and control of credit borrowed from lenders. Payback interest rates are high, leading even the best of professionals to hoard on debt.

Inflation has led people to utilize their credit cards for essential spending, as their disposable income has drastically decreased in this economy. Due to the reality of financial literacy Sri Lankans are equipped with, they subconsciously over spend their credit card limit while becoming a victim of the debt trap.

If you are a CDB credit card customer, the CDB iControl Application solves the debt trap problem caused by mismanagement of your credit cards. CDB credit card members are entitled to a lifetime annual fee waiver and access to CDB iControl Application.

The CDB iControl App provides credit control literacy through the app, by helping their customers get smart with credit card spending decisions.

Why become a CDB iControl Application member today?

Citizens Development Business Finance PLC invites all CDB Credit Card customers to experience a fully fledged credit control application, introduced for the first time in Sri Lanka. As a privileged CDB credit card customer, the iControl application provides eligibility to manage your credit card spending wisely.

Customers with credit cards can use the CDB iControl App to limit their spending and avoid making impulsive purchases. Mastercard clients can get the most extreme advantage out of their Visa without falling into debt, by utilizing the CDB

iControl Application.

The CDB iControl App helps you keep track of and control your spending limit while also psychologically preventing you from spending unnecessarily.

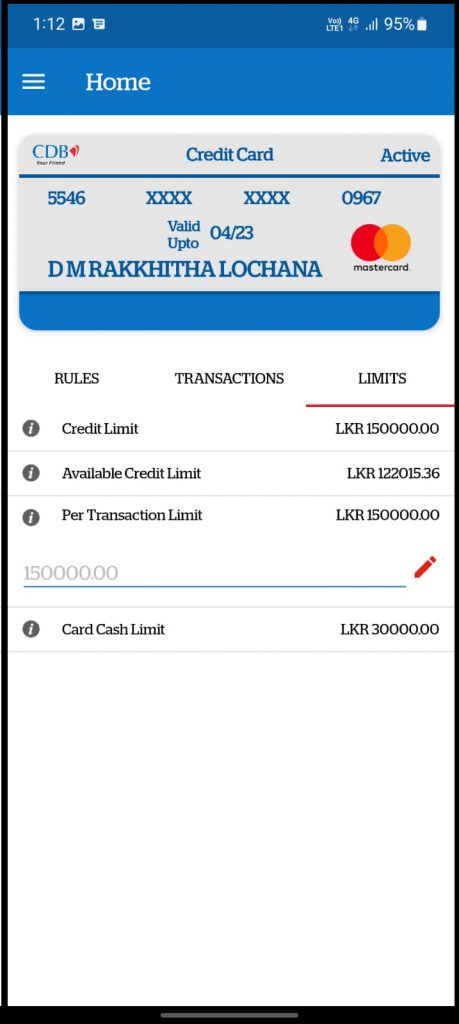

You can monitor your CDB credit cards at your own management, where you are given the full rights of setting your monthly maximum spending limit for different purchasing categories that you use the respective credit cards to spend with.

The CDB iControl Application isn’t simply a Credit Card Management Application that saves you from unnecessary expenditure. It also saves you from becoming a victim to scams, saves your time, protects your mental peace and keeps you on track money wise.

CDB iCONTROL APPLICATION FEATURES

Your credit card spending is now in control with CDB iControl’s best features that are user friendly and help you keep your spending in order.

If you wish to apply for a credit card at CDB, get more insight about CDB iControl Application here.

The CDB iControl App is designed with a user interface that is interactive for users who are looking for simple navigations to track their spending limits. The application covers the following smart features:

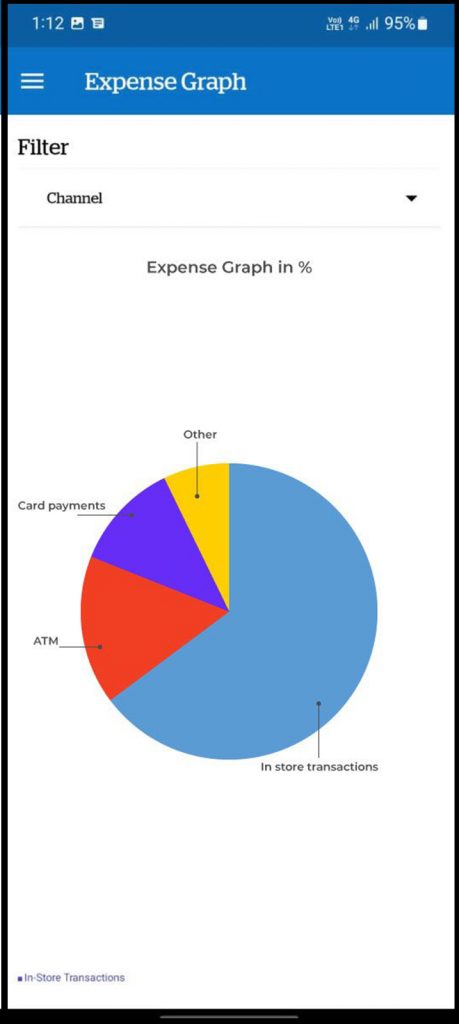

1.CDB iControl App users (customers) are shown a track record of their credit card spendings graphically. (The data representation is designed only for consumers to merge and subjugate their spending patterns accordingly)

2. Customers are given the independence to set their preferred sub-limits for different purchase categories. This strategy is emphasized to show that the CDB iControl App is a support system for customers to be literate in finance management.

3. For example, you can discipline your Credit card expenses including shopping, dining outside, fuel, travel & entertainment and utility bills, by managing your credit card spending categories for better understanding of your spending habits.

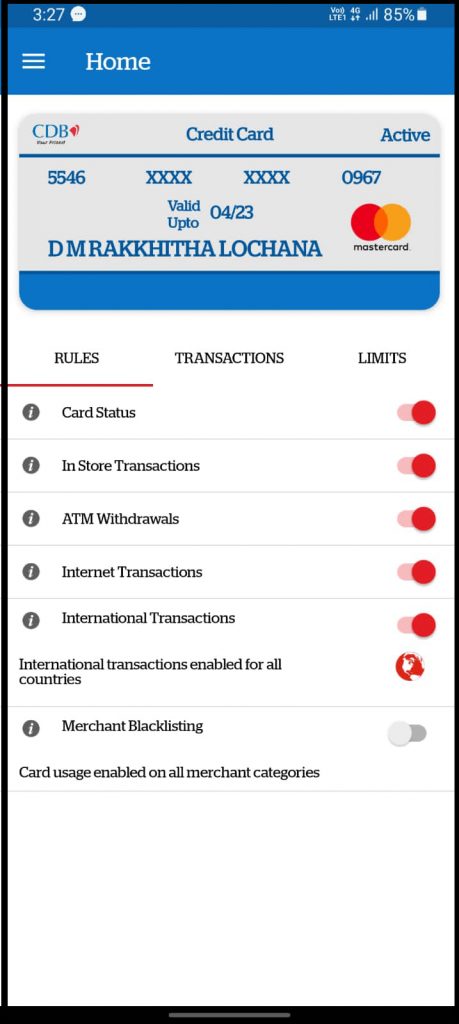

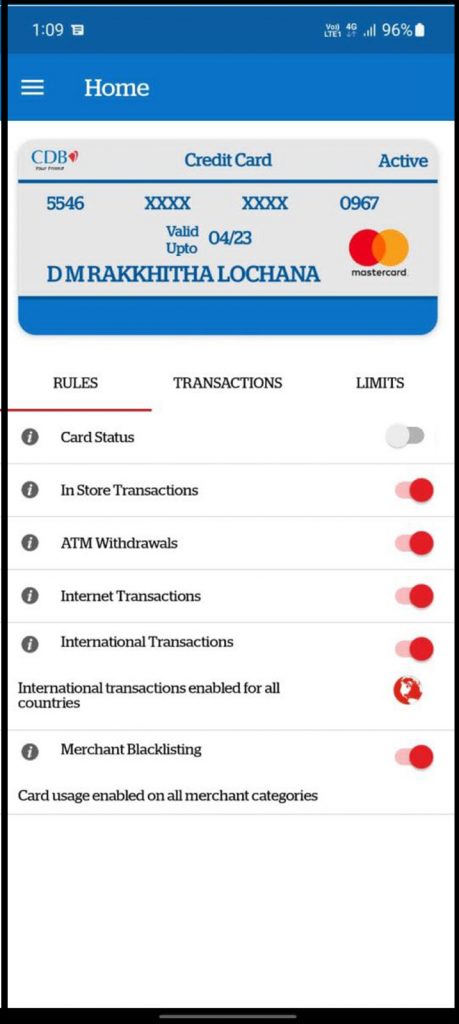

4. Another convenient feature of this App implies, during the case of an emergency or if your card is stolen you can block your card instantly using this App without having to contact the call center.

5. The CDB iControl App has enforced an awareness and organized systems for consumers to make payment decisions made in different countries and foreign merchants. This feature enables processing through layers of security screening and is supported orderly through the app. Furthermore, customers are not required to contact the call center when they are required to activate or deactivate their credit cards, while they travel globally. This action can be performed conveniently at their fingertips through the CDB iCONTROL Application instead.

A CDB customer is additionally benefited in their long term finances when they sign up for a CDB credit card, from any branch island wide.

The customer can pursue an advantage of desired luxury when they sign up for a CDB credit card that provides a lifetime annual fee waiver!

Download the CDB iControl Application from Google Play Store or iOS App Store for free today!

Get more insights on the preview of CDB iControl application and it’s incredible features by looking up on their website.